Bitcoin (BTC) Price Risks Continue As Demand Declines

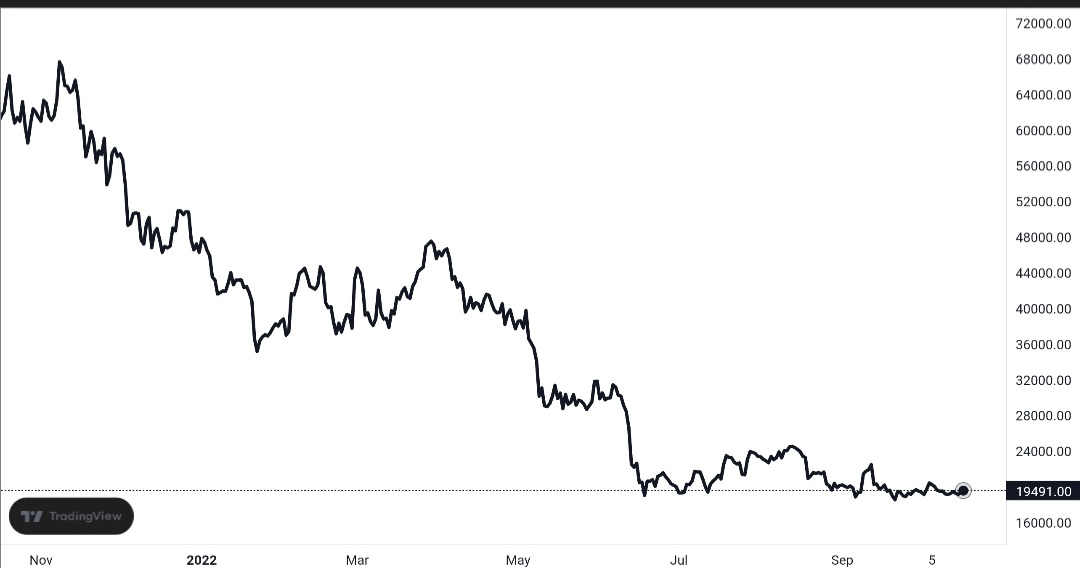

The price movement of Bitcoin has been sluggish in recent weeks as it consolidates around the $19k region. Market participants have been waiting for the coin to pick pace. However, it appears that may not happen anytime soon.

Bitcoin’s Price Still Below $20,000

Bitcoin’s price behavior has disappointed investors in the past month as it remains trapped below the $20,000 price mark. A tight liquidity band at the $19,000 level has caused the price of the digital currency to drop.

BTC/USD Price Chart. Source: TradingView

Additionally, both bears and bulls have been unable to push the price in either direction. By press time, Bitcoin was trading at $19,472, down by 1.08% in the last 24 hours.

Today, the global crypto market cap moved similarly to the price of Bitcoin. By press time, the market cap was at $964 billion.

Meanwhile, the market is optimistic about a rebound after a prolonged period of negative sentiment. Unfortunately, Bitcoin’s technical analysis does not yet show any signs of rebounding.

On the long-term chart, BTC’s price is getting close to the lower levels it reached in late 2020. This was after the coin recovered from the decline caused by the epidemic.

One of the most notable distinctions between the two time frames is the much larger trade volumes that are seen during the current period. On-chain data imply that short-term sentiment remained gloomy as the SOPR value was lower than 1.

Further, the comparison of SOPR and aSOPR data derived from CryptoQuant reveals that all participants who made purchases after December 2020 are currently experiencing a loss.

Funding Rate For Bitcoin Remains Low

Long-term holders of SOPR values are going to have a difficult time regaining a positive movement any time in the near future. Also, in the short run, the SOPR values signify a negative movement in the market as Bitcoin’s price dropped below the $19,500 resistance.

Meanwhile, the consumer demand for Bitcoin in the spot market remained generally consistent. However, it is apparent that the perpetual futures market also substantially impacted Bitcoin’s short-term price volatility.

Therefore, it is useful to gauge the futures market’s sentiment in times of uncertainty. Also, BTC’s financing rates are once more in the negative region as the price fell from the $22,000 mark and began to consolidate at $19,000.

Interestingly, funding rate values remain much lower than in the 2019-2021 timeframe. This shows a severe lack of interest and operation in the futures market.

Overall, Bitcoin’s price may remain in its range bound trend for a long time before making any significant movements. This is due to the crypto market’s strong macroeconomic uncertainty and low demand.